For Which of the Followong Is a Fiscal Policy Used

Chelliah recommends that fiscal policy must aim at the following for attaining rapid economic growth. Keep inflation low the UK government has a target of 2 Fiscal policy aims to.

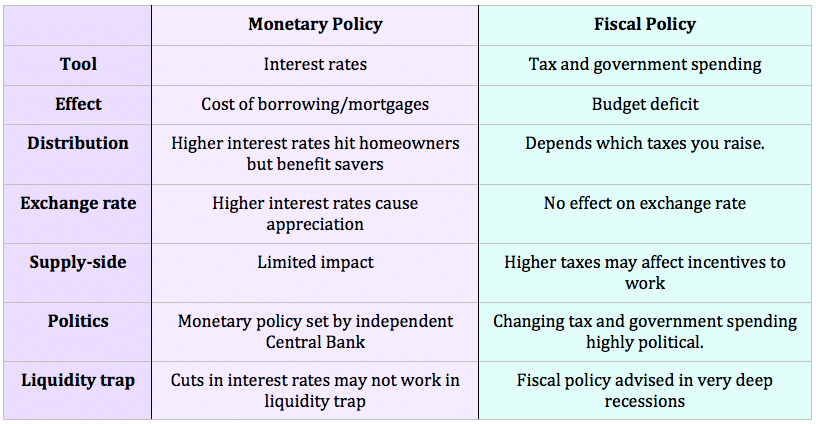

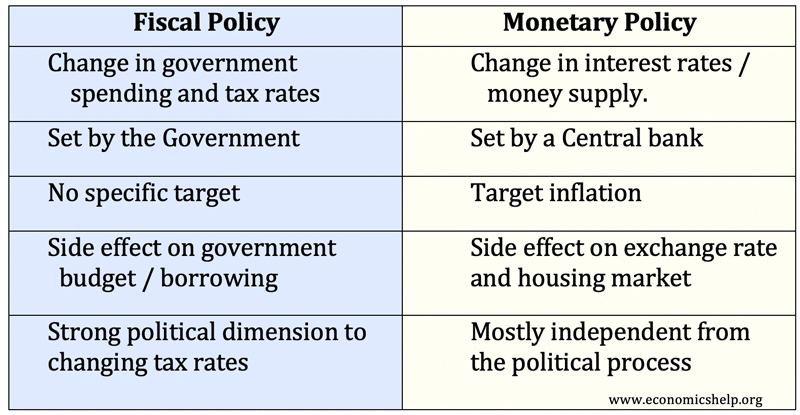

Monetary Policy Vs Fiscal Policy Economics Help

Progressive Tax A progressive tax is a tax rate.

. Which of the following is a fiscal policy tool used by Congress that influences the money supply and interest rates. Open Market Operations c. But fiscal policy is also.

In the executive branch the President and the. Fiscal policy used to close an expansionary gap is known as _____. The first type of fiscal policy is a neutral policy which is also known as a balanced budget.

The overall economic policy that guides. The main goals of fiscal policy are to achieve and maintain full employment reach a high rate of economic growth and to keep prices and wages stable. The planning and building of the libraries represents animpact lag of this policy.

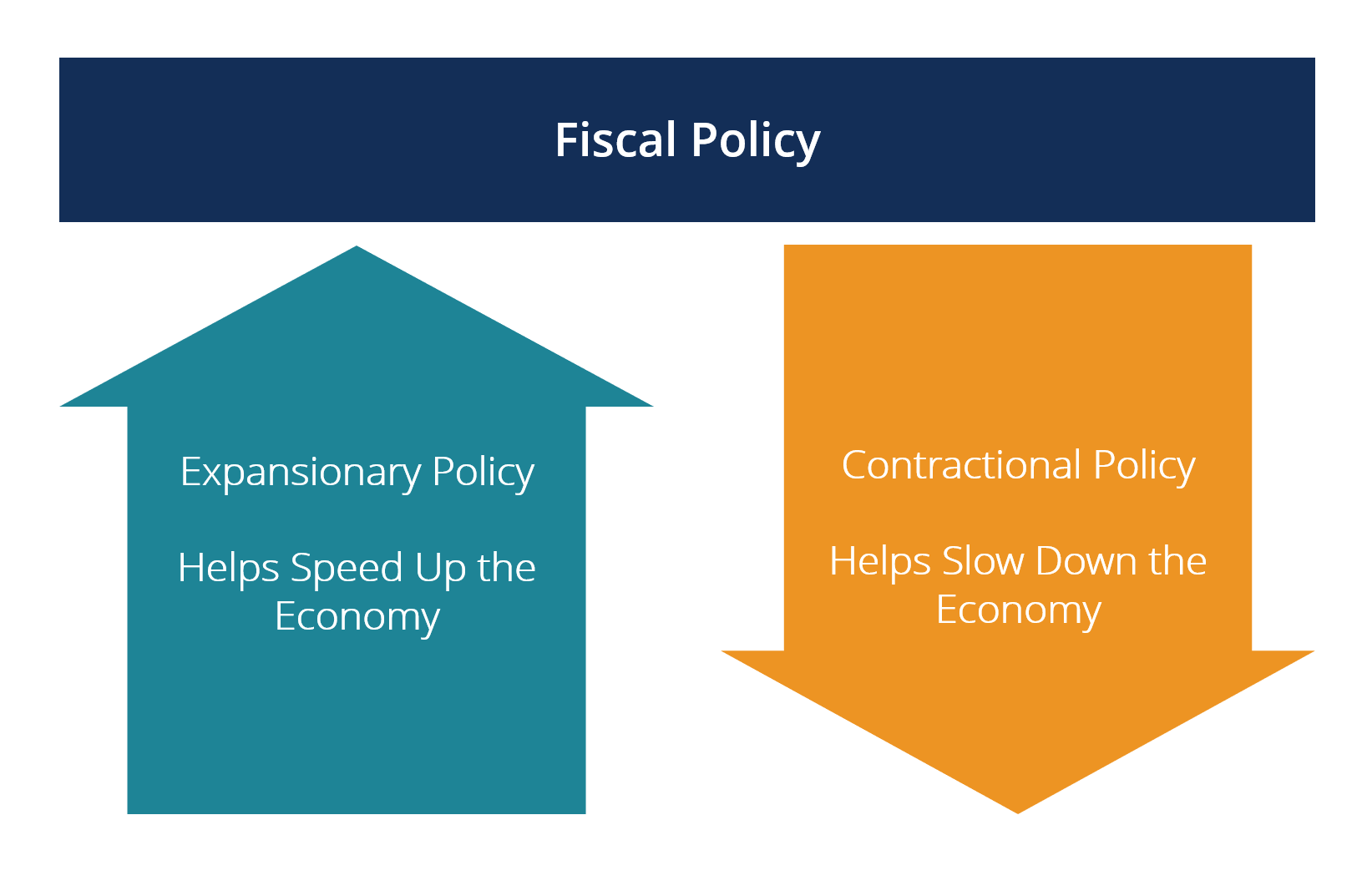

Stimulate economic growth in a period of a recession. Fiscal policy refers to the budgetary policy of the government which involves the government controlling its level of spending and tax rates. A Lower interest rates B Increased imports C Reducing inefficient employment of resources D Increased.

Some of the major instruments of fiscal policy are as follows. Supply-side economics argues that a cut in taxes will lead to a strong incentive for. The purpose of Fiscal Policy.

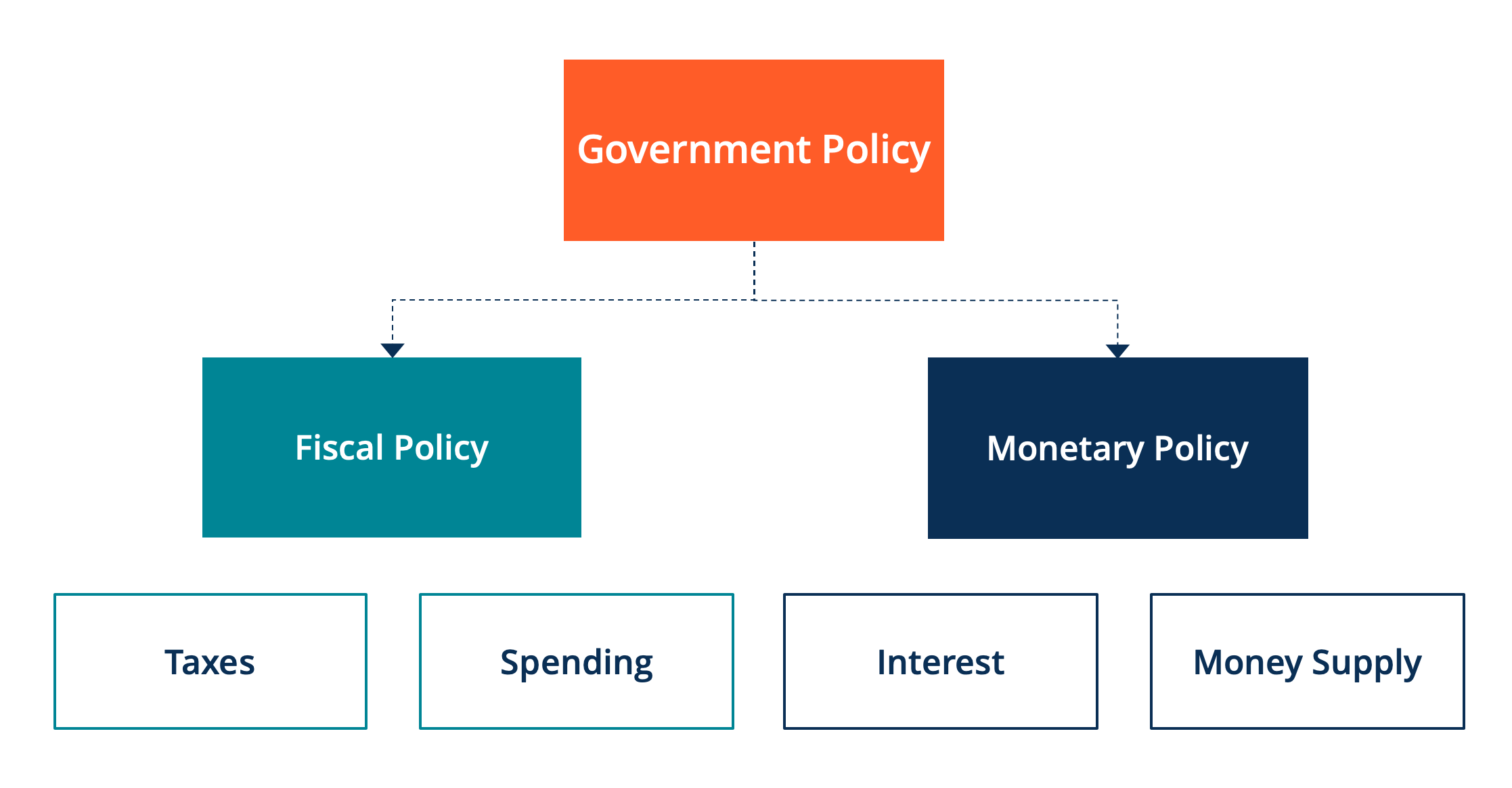

The two powerful weapons used by the government to achieve economic stability are tax rates and public spending. Reducing inefficient employment of resources c. Fiscal policy is the use of government spending and taxation to influence the economy.

In the United States fiscal policy is directed by both the executive and legislative branches of the government. Which of the following is a fiscal policy tool used to stimulate the economy. QUESTION 39 Which of the following is a fiscal policy tool used to cool off the economy reduce aggregate demand in order to fight inflation.

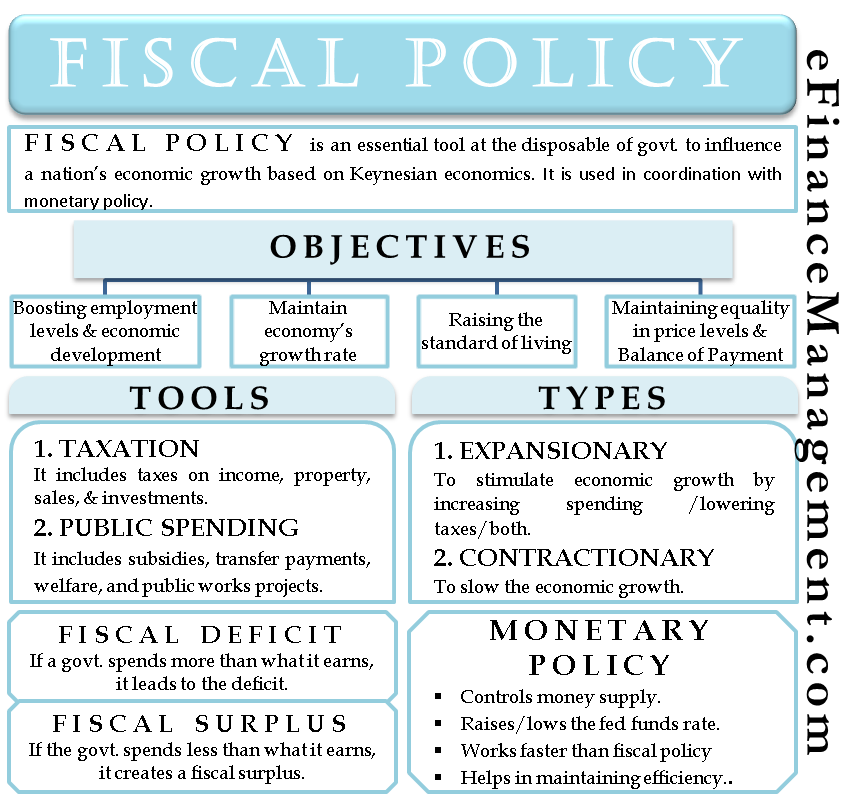

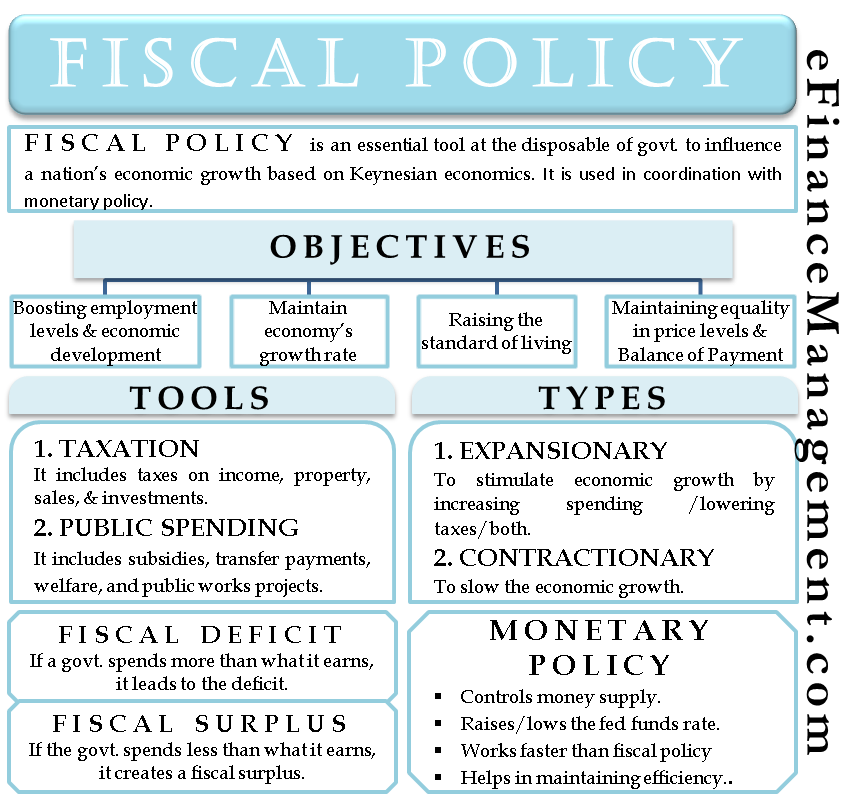

Fiscal policy is an essential tool at the disposable of the government to influence a nations economic growth. The fiscal policy is used in coordination with the monetary policy. Fiscal policy is just one portion of economic policy referring solely to the taxation and spending portion that is controlled by Congress.

Fiscal policy is the use of government spending and tax policy to influence the path of the economy over time. Which of the following is a fiscal policy tool used to stimulate the economy. Fiscal policy is used to influence the aggregate demand in a country whereas monetary policy is used to control the amount of money available throughout the economy.

Animpact lag is the. By using subsidies transfer payments including welfare programs and income tax cuts expansionary fiscal policy puts more money into consumers hands to give them more. Graphically we see that fiscal policy whether through changes in.

I Raising the ratio of saving s to Income y by controlling consumption. This is where the government brings in enough taxation to pay for its expenditures. Higher interest rates b.

Is the deliberate manipulation of government purchases. Expand peak contract and trough are prominent phases of an economic. Prime Lending Rate b.

Governments typically use fiscal policy to promote strong and sustainable growth. An impact lag would be present. Fiscal policy is used less frequently than monetary policy as a stabilization tool because all of the above.

Discretionary fiscal policy _____. The budget of a nation is a useful.

Fiscal Policy Overview Of Budgetary Policy Of The Government

Fiscal Policy Overview Of Budgetary Policy Of The Government

What Is Fiscal Policy Its Objectives Tools And Types

Difference Between Monetary And Fiscal Policy Economics Help

No comments for "For Which of the Followong Is a Fiscal Policy Used"

Post a Comment